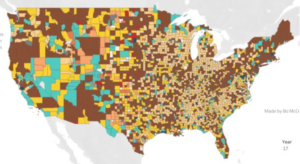

This visualization shows the most common job types by American county using data using data from the County Business Patterns (CBP) survey.

This visualization shows the most common job types by American county using data using data from the County Business Patterns (CBP) survey.

Counties are colored by North American Industry Classsification System (NAICS) codes.

Bovee and Thill offer innovative ideas and resources for teaching introduction to

business, so instructors can spend less time preparing and more time teaching.

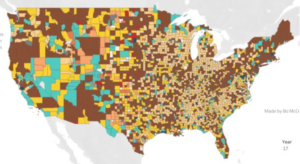

This visualization shows the most common job types by American county using data using data from the County Business Patterns (CBP) survey.

This visualization shows the most common job types by American county using data using data from the County Business Patterns (CBP) survey.

Counties are colored by North American Industry Classsification System (NAICS) codes.

The digital transformation movement is underway and affecting all types of industries. As recent trends in banking have shown, the financial sector is undergoing many changes as technology continues to make financial companies more successful and create better relationships with their customers. As technology continues to advance and change organizations, what kind of trends can we expect to see re-evaluate the financial sector in the coming years.

The digital transformation movement is underway and affecting all types of industries. As recent trends in banking have shown, the financial sector is undergoing many changes as technology continues to make financial companies more successful and create better relationships with their customers. As technology continues to advance and change organizations, what kind of trends can we expect to see re-evaluate the financial sector in the coming years.

The evolution of game-changing technologies is leveling the playing field in many industries. The adoption of these technologies is on the rise, giving cognizance to forward-thinkers in various industries to reimagine what’s possible.

"The holiday season is a hectic and crucial time for all retailers, not to mention a chaotic, trying time for retail workers who have to deal with Black Friday stampedes or ramped-up online orders in the run-up to Christmas. But Amazon occupies a unique spot in the retail industry, thanks to its size and influence."

"2019 will see an increase in technology-driven organizations, as more businesses embark on the digital transformation journey. With artificial intelligence (AI), machine learning (ML) and robotic process automation (RPA) poised to usher in a new way of doing business, traditional business processes will soon cease to exist."

We asked 8 entrepreneurs from the Inc. 5000 list of fastest-growing companies what their biggest mistake was. The answers were surprising.

We asked 8 entrepreneurs from the Inc. 5000 list of fastest-growing companies what their biggest mistake was. The answers were surprising.

We did research on future trends in the financial industry and hopefully a year from now these trends will stay and inspire more improvements in how we deal with money.

But first, let’s recollect the innovations that have emerged in the FinTech industry during the past 12 months.

It’s not hard to see why people aren’t saving more money, but the data on personal savings is still more than a little shocking. While traditional financial wisdom is that we should save 3-6 months’ worth of bills and expenses for an emergency or rainy day, 40% of U.S. adults couldn’t even come up with $400 by the end of today without borrowing or using debt!

It’s not hard to see why people aren’t saving more money, but the data on personal savings is still more than a little shocking. While traditional financial wisdom is that we should save 3-6 months’ worth of bills and expenses for an emergency or rainy day, 40% of U.S. adults couldn’t even come up with $400 by the end of today without borrowing or using debt!

"The global banking sector is becoming both more strategically focused and technologically advanced to respond to consumer expectations while trying to defend market share against an increasing array of competitors. A great deal of emphasis is being placed on digitizing core business processes and reassessing organizational structures and internal talent to be better prepared for the future of banking. This transformation illustrates the increasing desire to become a ‘digital bank.'"

"The global banking sector is becoming both more strategically focused and technologically advanced to respond to consumer expectations while trying to defend market share against an increasing array of competitors. A great deal of emphasis is being placed on digitizing core business processes and reassessing organizational structures and internal talent to be better prepared for the future of banking. This transformation illustrates the increasing desire to become a ‘digital bank.'"